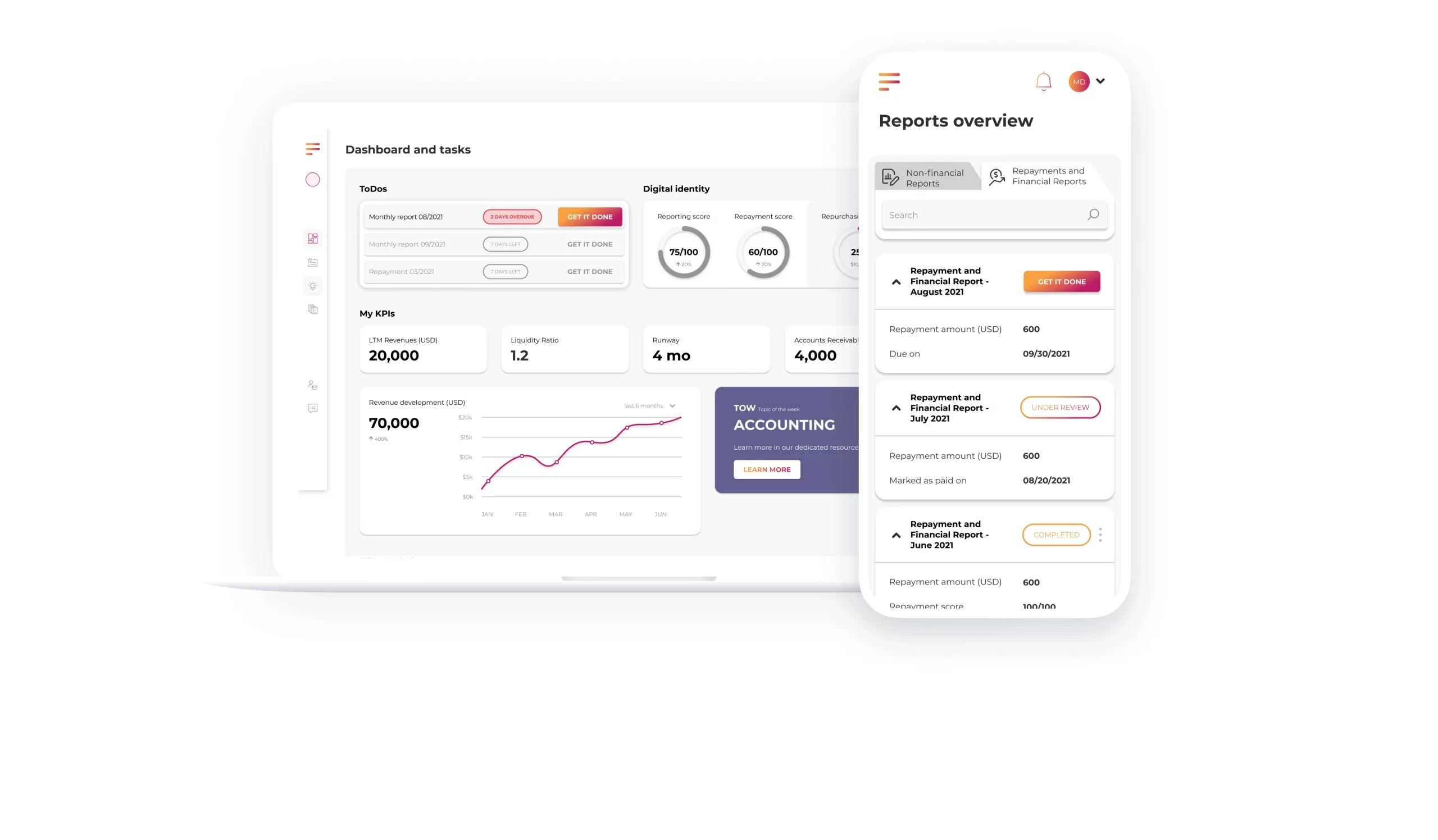

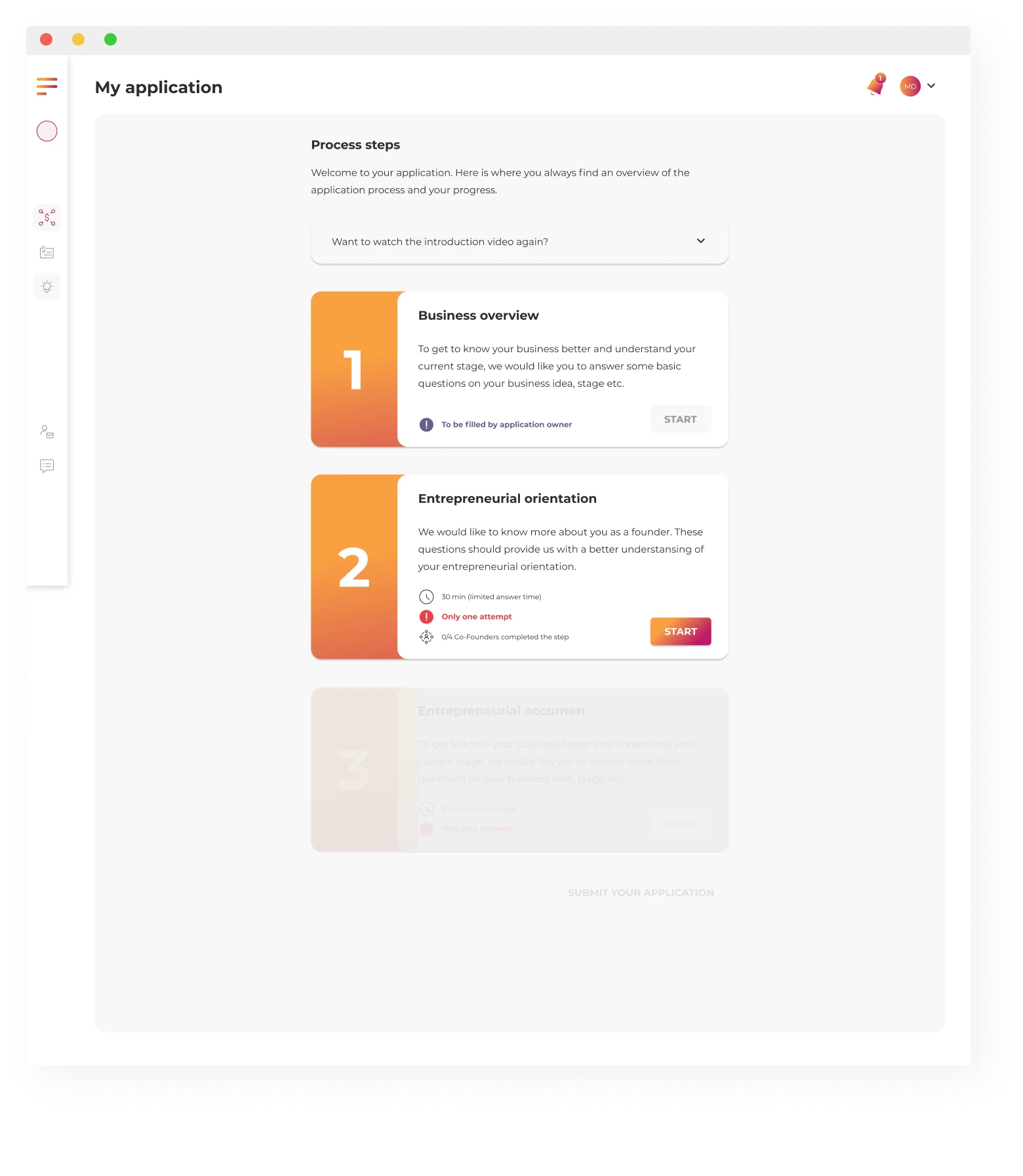

The Challenge

When Uncap contacted us, they had an expertly-documented idea for the project that outlined the rules and requirements of processing the applications, choosing the most promising ones, applying data-focused screening, and for managing the investment rounds (both from the investor and the business-owner perspective). They also had a set of initial designs for the platform. They needed, however, a technical partner that could quickly develop the product.

Key challenges of the project included:

- Translating business vision into a digital product

- Defining constraints, and the most optimal delivery workflow

- Finding the most efficient way of implementing numerous third-party integrations that the platform requires